Who is Equity Smart Home Loans?

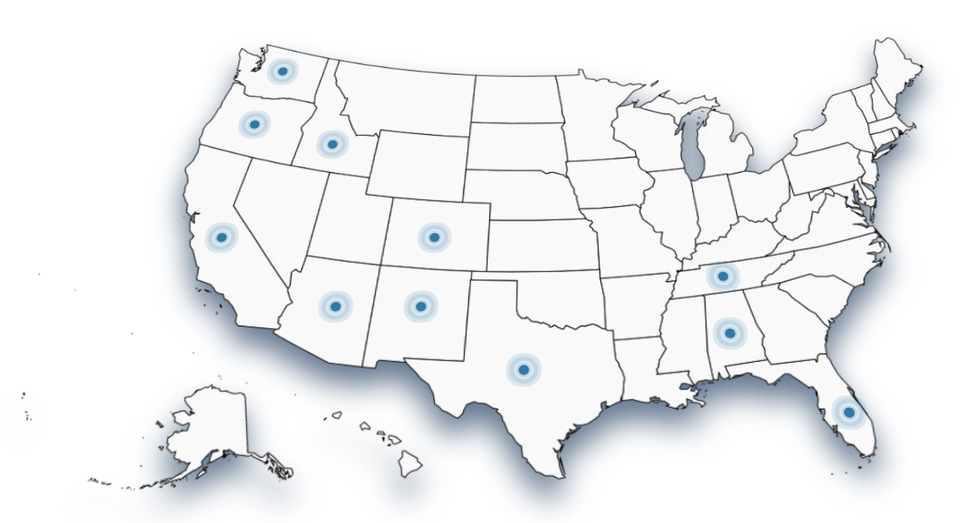

Founded in 2001 and headquartered in Pasadena, California, Equity Smart Home Loans is a leading mortgage company licensed in 10 states and committed to helping people build wealth through homeownership. For over 20 years, we’ve helped families and investors secure the right financing to strengthen their future. We believe every client deserves personalized guidance, honest advice, and a loan strategy built around their goals.

Loans by Monica, powered by Equity Smart Home Loans, proudly serves Lauderhill and the surrounding South Florida communities with local expertise, transparency, and care. We’re more than mortgage professionals, we’re long-term partners in your journey. Whether you’re buying your first home, refinancing, or exploring new opportunities, our team is here to guide you with clarity, confidence, and a truly customized experience.

Your goals matter here. And we’re honored to help you reach them.